GigaCloud Technology: Why This Small-Cap Stock Could Be Your Next Big Win

In the ever-shifting landscape of the Australian stock market, identifying undervalued companies with significant growth potential is a key strategy for savvy investors. While many eyes are on the established blue-chips, a compelling opportunity is quietly emerging in the small-cap space: GigaCloud Technology Inc. (GCT).

Recently lauded as ‘America’s Most Successful Small Cap Company 2025’ (a title that speaks volumes about its trajectory), GigaCloud is a company that deserves a closer look, particularly for those seeking a contrarian investment with substantial upside.

What Does GigaCloud Do?

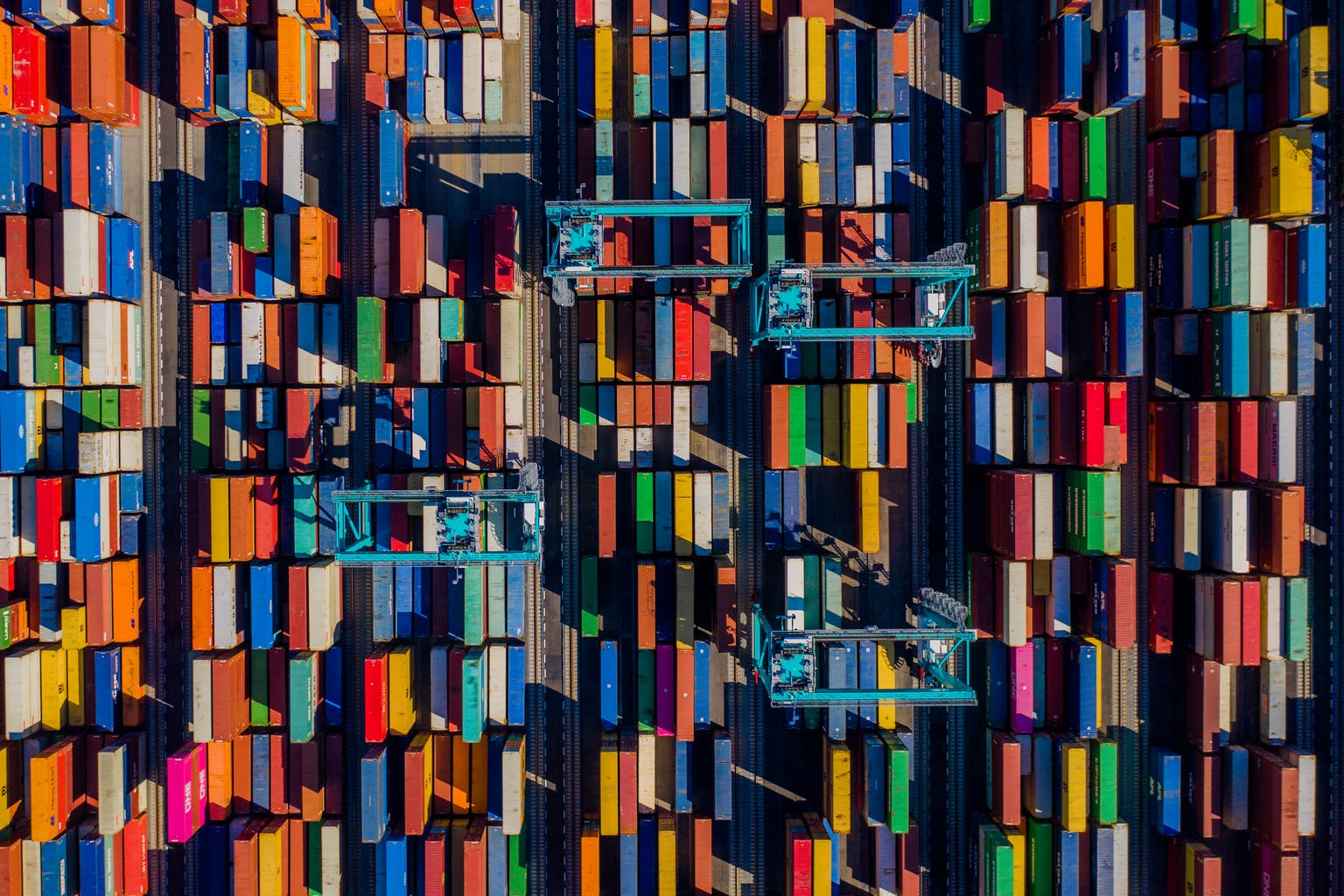

GigaCloud operates within the logistics and supply chain management sector, but with a distinctly modern and technology-driven approach. They focus on providing a network-based transportation marketplace connecting shippers and carriers across North America. This isn't your typical freight brokerage; GigaCloud leverages proprietary technology to optimise routes, improve efficiency, and provide real-time visibility into shipments. This creates a win-win scenario for both shippers (reduced costs, improved service) and carriers (increased access to loads, streamlined operations).

Why the 'Underappreciated' Label?

Despite its impressive growth and recognition, GCT stock remains relatively under the radar compared to other tech companies. Several factors contribute to this: its small-cap status, the cyclical nature of the transportation industry, and potentially, a lack of widespread analyst coverage. However, these very factors present an opportunity for investors who are willing to do their homework and embrace a contrarian view.

The Contrarian Thesis: Why Now is the Time

The current market environment is ripe for a reassessment of GigaCloud's potential. Several key trends support a bullish outlook:

- E-commerce Boom Continues: The ongoing surge in online shopping fuels the demand for efficient and reliable logistics solutions. GigaCloud is well-positioned to capitalise on this trend.

- Supply Chain Disruptions: Recent global events have highlighted the vulnerabilities of traditional supply chains. Companies like GigaCloud, offering greater visibility and flexibility, are increasingly attractive.

- Technology Adoption in Logistics: The transportation industry is undergoing a digital transformation, and GigaCloud is at the forefront, leveraging technology to gain a competitive edge.

- Strong Financial Performance: GigaCloud has consistently demonstrated strong revenue growth and improving profitability, indicating a solid business model and effective execution.

Looking Ahead: GCT Stock Prospects

While no investment is without risk, the potential rewards associated with GigaCloud Technology are compelling. The company's innovative approach, strong market position, and favourable industry tailwinds suggest that it has a bright future. Investors should carefully consider their own risk tolerance and conduct thorough research before making any investment decisions, but GCT warrants a place on any discerning investor’s watchlist. The 'America’s Most Successful Small Cap Company 2025' title isn't just a boast; it’s a testament to the company’s potential and a signal that GCT could be your next big win in the Australian market.