Is Willis Lease Finance (WLFC) Overvalued? Margin Concerns Signal a 'Hold' Rating

Willis Lease Finance Group (WLFC) has been a compelling story in the asset-backed financing space, particularly in the aviation and energy sectors. The company's unique business model, focused on leasing, remarketing, and financing assets, has historically generated strong returns. However, recent market dynamics and evolving industry trends are prompting a closer look at whether the current stock price reflects the company's true potential. Our analysis suggests that much of the positive tailwind has likely been priced into WLFC, and margin pressures warrant a cautious approach.

The Allure of Willis Lease Finance

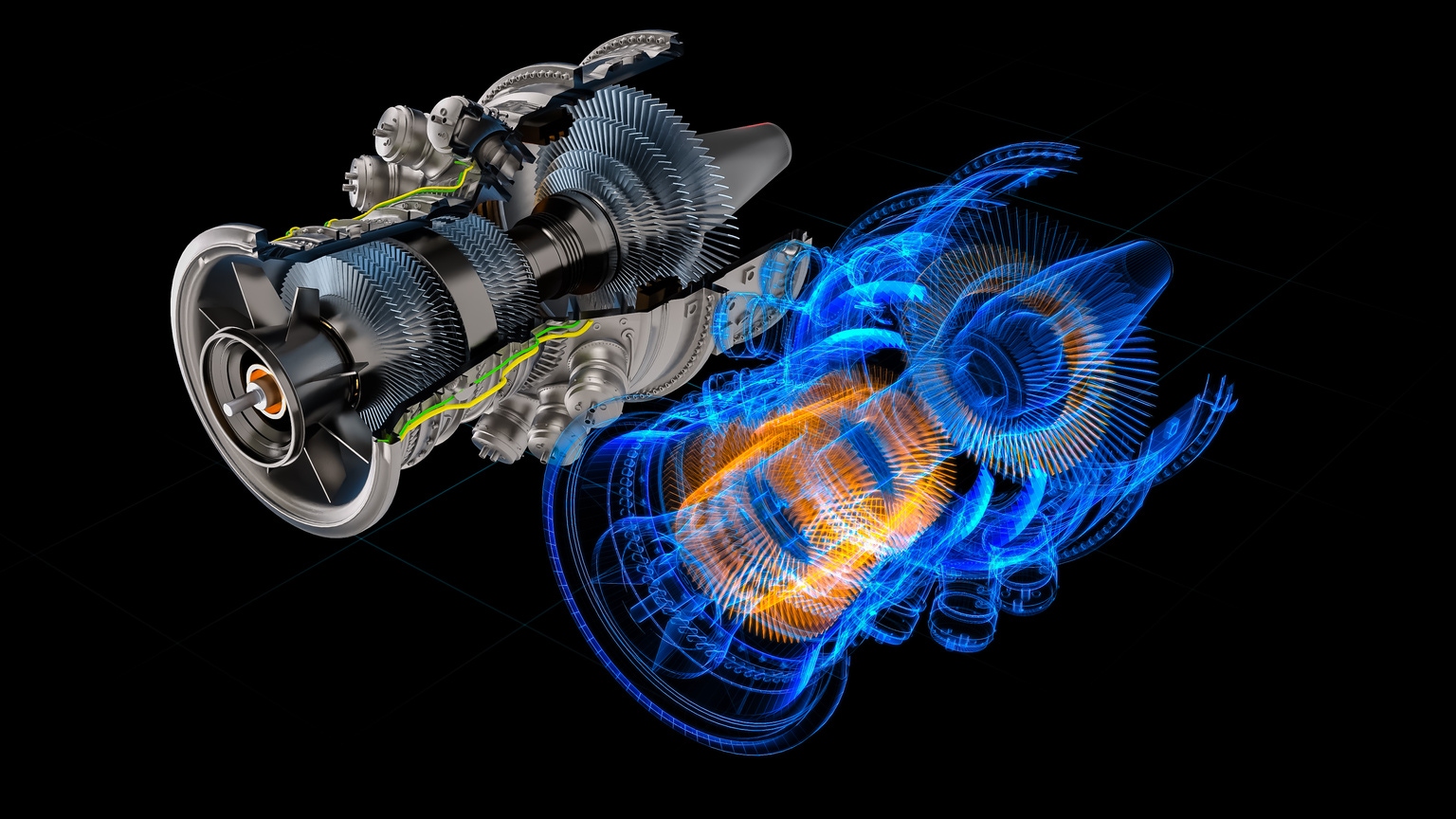

WLFC's strength lies in its ability to navigate complex asset markets. By acquiring, leasing, and remarketing aircraft and energy equipment, the company benefits from both the upside of asset appreciation and the steady income stream from lease payments. This diversification helps mitigate risk and provides a degree of resilience against economic downturns. The company’s management team has a proven track record of identifying undervalued assets and generating attractive returns. Furthermore, the post-pandemic recovery in air travel initially fueled a surge in demand for aircraft leasing, further boosting WLFC's performance.

Margin Concerns: A Growing Headwind

While the company's fundamentals remain solid, a key concern is the shrinking margin profile. Rising interest rates, inflationary pressures, and increased competition are all contributing to downward pressure on margins. The cost of capital has increased significantly, impacting the profitability of new lease agreements. Additionally, the market for aircraft and energy equipment is becoming increasingly competitive, forcing WLFC to offer more attractive lease terms to secure deals. These factors are collectively squeezing margins and potentially impacting future earnings growth.

Is the Stock Price Already Reflecting the Good News?

The stock price has already benefited significantly from the post-pandemic recovery and the perceived resilience of WLFC's business model. While the company is well-managed and possesses a unique niche, the current valuation appears to be pricing in a significant amount of future growth. Given the margin concerns and the increasingly challenging macroeconomic environment, it's reasonable to question whether the stock price has already captured most of the potential upside.

Why a 'Hold' Rating?

Based on our analysis, we are maintaining a 'Hold' rating on WLFC stock. While we acknowledge the company's strengths and its potential for long-term success, the margin pressures and the elevated valuation make us hesitant to recommend a buy. We believe that investors should closely monitor the company's earnings reports and industry trends before making any investment decisions. Specifically, we will be watching for signs of margin stabilization and evidence of WLFC's ability to navigate the competitive landscape effectively. A significant improvement in margins or a more attractive valuation could prompt a reevaluation of our rating.

Looking Ahead

The future for Willis Lease Finance will depend on its ability to adapt to the changing market conditions. This includes managing costs effectively, maintaining a competitive lease pricing strategy, and identifying new opportunities for asset acquisition and remarketing. The company's management team will need to demonstrate their ability to navigate these challenges and deliver sustainable earnings growth. Until then, a cautious approach is warranted.