New Mountain Finance (NMFC): Is a 13% NAV Discount Enough to Overcome Dividend Risks?

New Mountain Finance Corporation (NMFC) has recently caught the attention of income-seeking investors, primarily due to a compelling 13% discount to its Net Asset Value (NAV). This discount, coupled with the company's generally stable credit quality, presents a potentially attractive opportunity. However, it's crucial to delve deeper and assess the associated risks, particularly concerning dividend sustainability.

Understanding New Mountain Finance

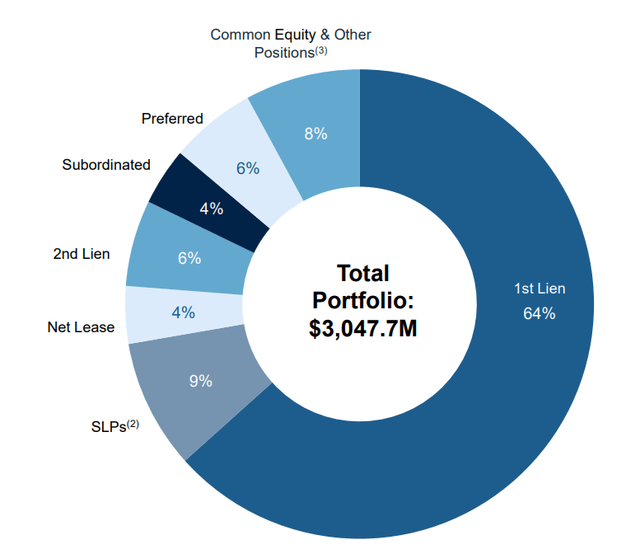

NMFC is a business development company (BDC) focused on providing financing to middle-market companies. These companies often lack access to traditional capital sources, making BDCs like NMFC vital players in the financial ecosystem. NMFC primarily invests in first lien secured loans, meaning they hold a top priority claim on the borrower's assets in case of default, offering a degree of downside protection.

The Alluring 13% NAV Discount

A 13% discount to NAV is a significant factor. It suggests the market is undervaluing NMFC's underlying assets. This can be due to various reasons, including broader market sentiment towards BDCs, concerns about the economic outlook, or specific anxieties regarding NMFC's portfolio. However, for patient investors, such discounts can represent a buying opportunity, allowing them to acquire assets at a price below their intrinsic value.

The Dividend Question: A Critical Consideration

The primary draw for many investors in NMFC is its dividend yield. While attractive, it's imperative to analyze the sustainability of this dividend. Several factors contribute to this assessment:

- Net Investment Income (NII): NMFC’s dividend payout ratio relative to its NII is a key indicator. A consistently high payout ratio (above 100%) can signal potential dividend cuts if NII declines.

- Portfolio Performance: The performance of NMFC's underlying portfolio is directly tied to its ability to generate income. Deterioration in credit quality or rising default rates can negatively impact NII.

- Economic Conditions: A weakening economy can put pressure on middle-market companies, potentially leading to loan defaults and reduced interest income for NMFC.

- NAV Trend: While a discount to NAV is currently present, a sustained downward trend in NAV can be a warning sign.

Recent Developments and Outlook

Recent economic data has presented a mixed picture. While inflation has cooled somewhat, interest rates remain elevated, impacting borrowing costs for middle-market companies. NMFC’s management has demonstrated a proactive approach to managing its portfolio, focusing on higher quality borrowers and carefully evaluating new investment opportunities.

Is NMFC a Buy?

The decision to invest in NMFC hinges on your risk tolerance and investment goals. The 13% NAV discount is undeniably attractive. However, the elevated dividend risk warrants careful consideration. Before investing, conduct thorough due diligence, analyze NMFC’s latest financial reports, and assess the overall economic outlook. Consider if you are comfortable with the potential for dividend adjustments.

Disclaimer: This is not financial advice. Please consult with a qualified financial advisor before making any investment decisions.