Cognizant's AI-Powered Turnaround: Is Now the Time to Invest in CTSH?

Cognizant Technology Solutions (CTSH) has been quietly executing a remarkable transformation. After facing headwinds in recent years, the company is demonstrating renewed vigor, fueled by accelerating growth, strategic investments in Artificial Intelligence (AI), and a well-defined turnaround plan. This isn't just a recovery story; it's a potential inflection point that could lead to a significant re-rating of its valuation.

The Growth Story is Back

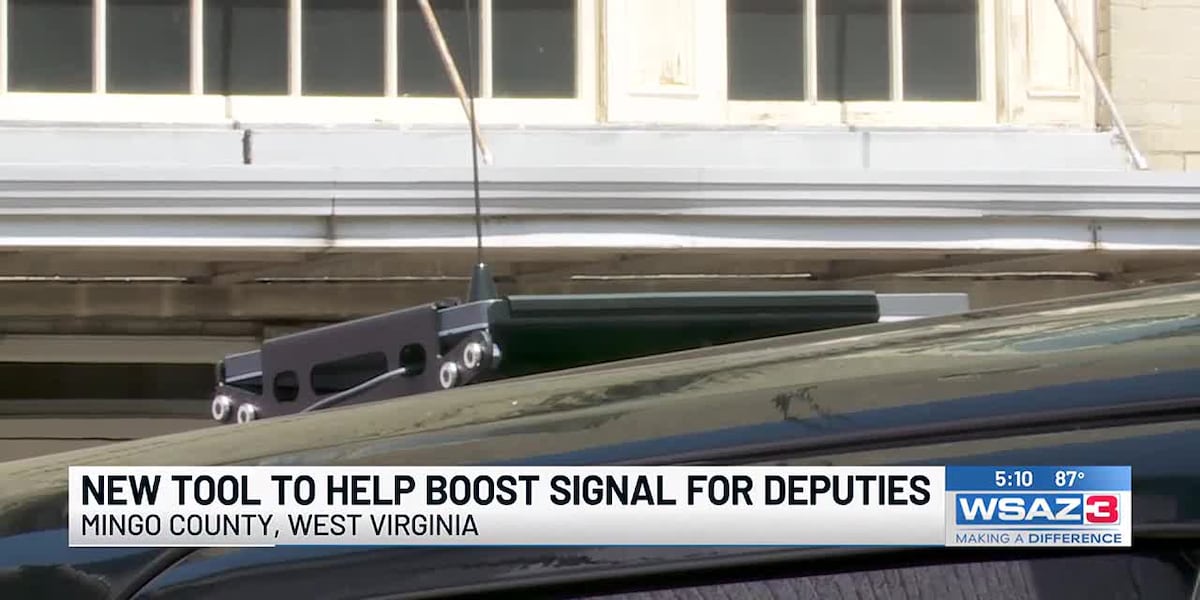

For a while, Cognizant's growth narrative seemed to have stalled. However, recent earnings reports tell a different tale. The company is experiencing a resurgence in organic growth, driven by strong demand in key areas like digital transformation, cloud computing, and data analytics. This growth is not just superficial; it's being powered by a focus on high-value services and a strategic shift towards more profitable engagements.

AI: The Catalyst for Value Creation

What truly sets Cognizant apart is its aggressive and intelligent embrace of AI. The company isn't just talking about AI; they're embedding it into their service offerings, creating new revenue streams, and improving operational efficiency. Cognizant's investments in AI platforms and talent are positioning them as a leader in helping clients navigate the complexities of AI adoption. This includes everything from AI-powered automation and intelligent process optimization to developing custom AI solutions for specific business needs. Their focus on generative AI is particularly noteworthy, given its transformative potential across industries.

A Successful Turnaround Strategy: Beyond Cost-Cutting

Cognizant's turnaround isn't just about cutting costs (though that has been part of the equation). It's about fundamentally reshaping the company's business model, focusing on higher-growth areas, and improving operational agility. Key elements of this strategy include:

- Portfolio Optimization: Exiting non-core businesses and focusing on areas with higher growth potential.

- Digital Transformation Focus: Prioritizing digital services and cloud solutions.

- Operational Efficiency: Streamlining processes and leveraging automation to improve profitability.

- Talent Development: Investing in skills training and attracting top AI talent.

Why CTSH Stock is a 'Buy'

The combination of accelerating growth, AI-driven value creation, and a well-executed turnaround strategy makes CTSH stock a compelling investment opportunity. While the stock has seen some appreciation recently, we believe there is still significant upside potential. The market is only beginning to recognize the extent of Cognizant's transformation and the long-term value of its AI investments.

Risks to Consider

Like any investment, CTSH carries risks. These include:

- Macroeconomic Uncertainty: A slowdown in the global economy could impact demand for IT services.

- Competition: The IT services industry is highly competitive.

- Integration Risks: Acquisitions and strategic partnerships always carry integration risks.

Despite these risks, we believe that Cognizant's strong fundamentals and compelling growth prospects outweigh the potential downsides. The company is well-positioned to capitalize on the ongoing digital transformation wave and benefit from the increasing adoption of AI.

Disclaimer: This is not financial advice. Please consult with a qualified financial advisor before making any investment decisions.

:max_bytes(150000):strip_icc():focal(1207x874:1209x876)/couple-in-doctors-office2-7325-c51b1e294e69466aa178f267b897eda6.jpg)