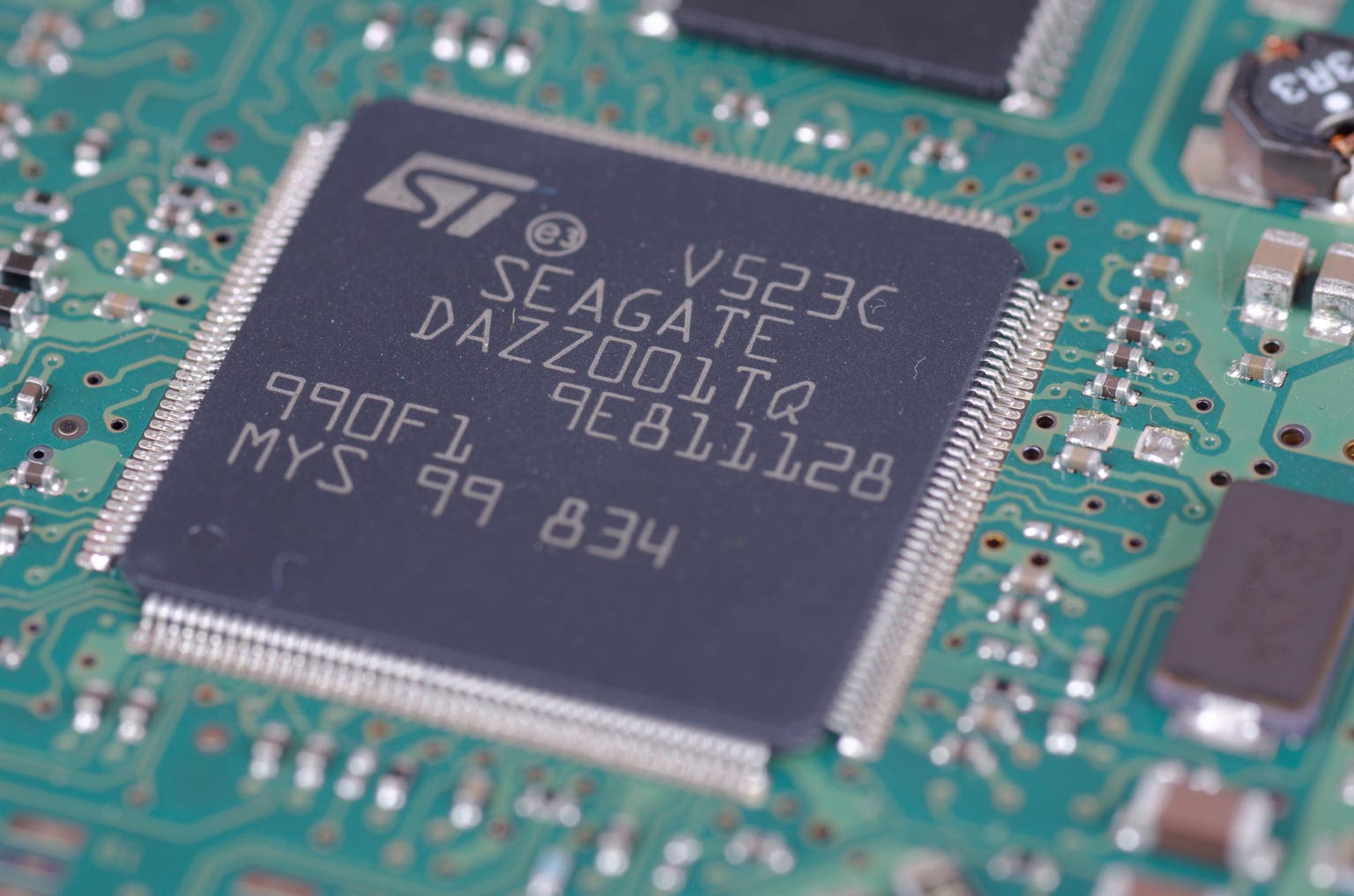

Seagate: Is This Data Storage Giant a Hidden Gem for Investors?

In the ever-expanding digital landscape, data storage is more critical than ever. While many companies struggle to keep pace with this relentless demand, Seagate Technology Holdings (STX) appears to be uniquely positioned for success. This analysis dives deep into why Seagate presents a compelling investment opportunity, combining a remarkably low Price-to-Earnings Growth (PEG) ratio, robust growth prospects, and groundbreaking innovation in the form of Heat-Assisted Magnetic Recording (HAMR) technology, all within a booming data market.

Why Seagate Stands Out in the Storage Sector

Seagate isn't just another storage company; it's a leader. The company designs and manufactures a wide range of hard drives and storage solutions for businesses, consumers, and cloud service providers. What makes Seagate particularly attractive right now is the confluence of several positive factors:

1. Undervalued by the Numbers: The Low PEG Ratio

The PEG ratio is a powerful tool for identifying potentially undervalued stocks. It considers a company's P/E ratio (price-to-earnings ratio) relative to its earnings growth rate. A PEG ratio below 1 often suggests a stock is undervalued, as it implies the market isn't fully appreciating the company's growth potential. Seagate's current PEG ratio is exceptionally low, signaling a significant disconnect between the company's performance and market expectations. This presents a potentially lucrative opportunity for investors.

2. Riding the Wave of Data Growth

The data deluge shows no signs of slowing down. Fueled by trends like cloud computing, artificial intelligence, the Internet of Things (IoT), and the proliferation of streaming services, global data generation is exploding. This translates to increased demand for storage solutions, and Seagate is well-positioned to capitalize on this growth. The company’s diverse customer base, spanning enterprise, consumer, and cloud sectors, provides a broad foundation for continued revenue expansion.

3. Innovation with HAMR Technology

Seagate is not resting on its laurels. The company is actively investing in research and development, particularly in HAMR technology. HAMR allows for significantly higher data density on hard drives, meaning more storage capacity in the same physical space. This innovation is crucial for meeting the ever-increasing storage demands of the future and maintaining Seagate's competitive edge. The rollout and adoption of HAMR will be key drivers of future growth and margin expansion.

4. Strong Financial Performance and Outlook

Beyond the compelling valuation and growth prospects, Seagate boasts a solid financial foundation. The company consistently generates healthy cash flow, which it can use to invest in future growth initiatives, return capital to shareholders through dividends or share buybacks, or reduce debt. Management’s guidance for future quarters reinforces the positive outlook, suggesting continued strength in demand and profitability.

The Case for STX Stock: A Strong Buy Recommendation

Considering the factors outlined above—the low PEG ratio, the burgeoning data market, the innovative HAMR technology, and the company’s strong financial performance—Seagate Technology Holdings presents a compelling investment case. The market appears to be overlooking the company’s potential, creating an opportunity for savvy investors to capitalize on its long-term growth trajectory. While all investments carry risk, Seagate’s combination of value and growth makes it a strong buy candidate for those seeking exposure to the data storage sector.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.